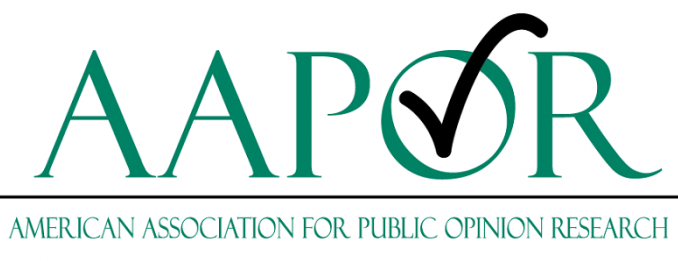

In the most recent survey from Modalis Public Opinion by Modus Research, over a third of Canadians indicate that the rising cost of living has had an increasingly strong negative impact on their household’s financial well-being over the past year.

Key findings in this release:

- The cost of living is having an increasing negative impact on Canadians’ financial well-being

- Canadians say they can’t keep up with the cost of living

- It is getting harder for Canadians to make ends meet

The impact of the cost of living is getting worse.

Over a third of Canadians say that they are feeling a strong negative impact on their household’s financial well-being as a result of the increasing cost of living, up from just over a quarter less than a year ago.

While this impact is most acutely felt among low income earners, a quarter of even those earning over $150k/year are strongly affected. The impact felt by Canadians as a result of the shift in the cost of living is exacerbating.

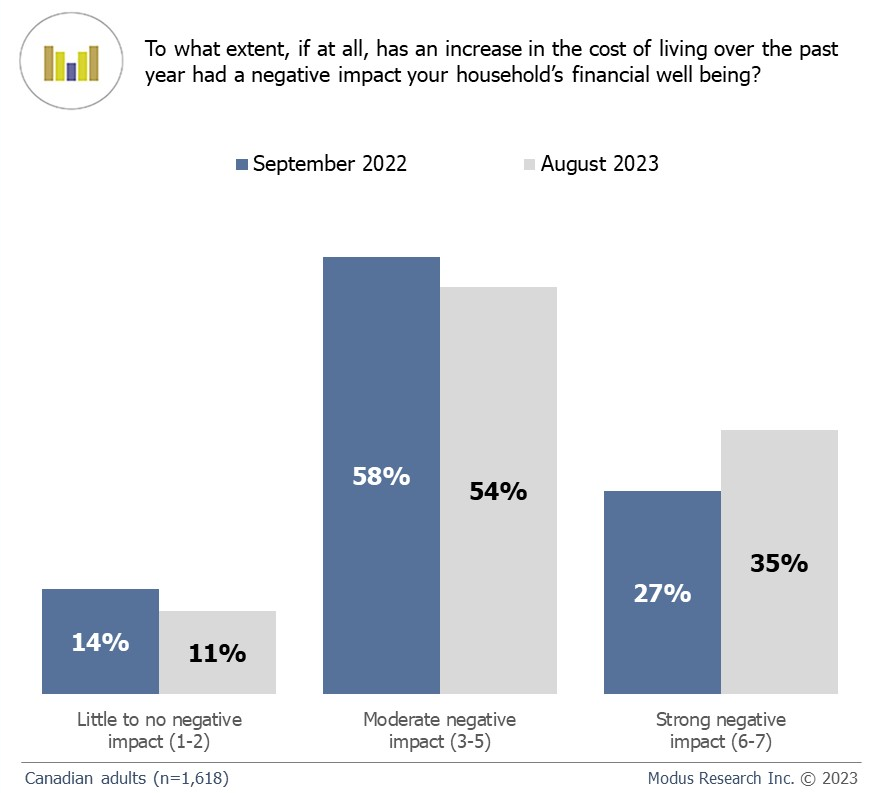

Canadians are having difficulty keeping up with the cost of living.

An alarming number of Canadians agree with the statement, “I can’t keep up with the cost of living.”

This number is as high as three-quarters among those making under $40k/year, but about half of even those making over $100k/year say they can’t keep up.

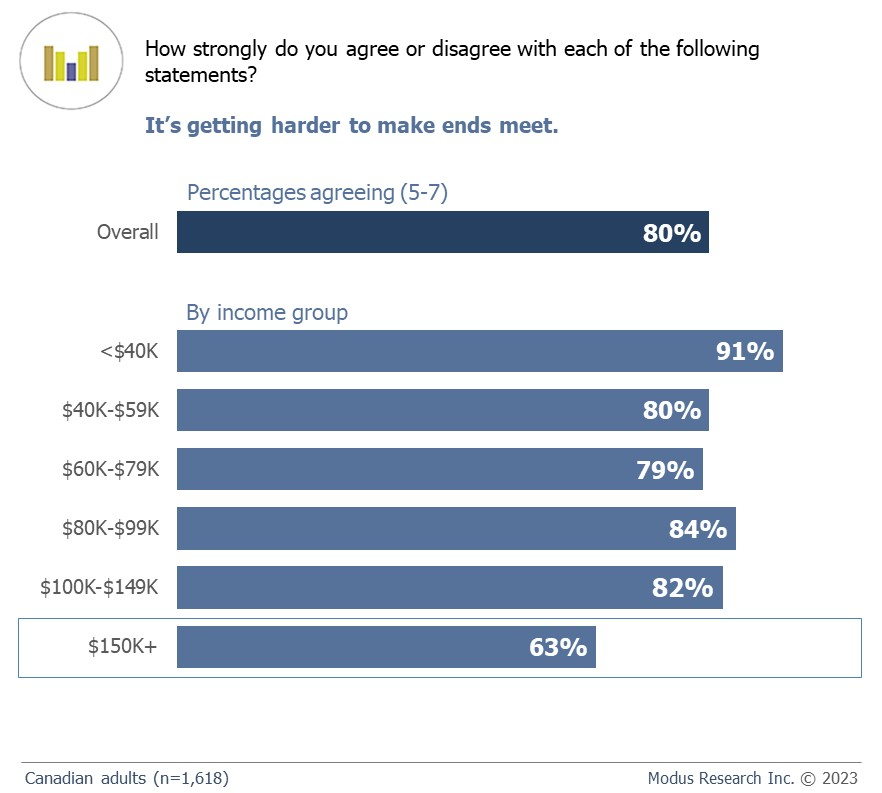

Canadians say it’s getting harder to make ends meet.

The vast majority of Canadians say it is getting harder to make ends meet, including virtually all of those who make under $40k/year.

Intuitively, one might think that low income earners would be the ones bearing the brunt of these issues, but the anxiety is widespread. Even among Canadians making over $150k/year, nearly two-thirds say they are struggling financially.

Discussion

There is a great amount of economic anxiety among Canadians at this time. The majority of Canadians, regardless of their income level, are finding it difficult to get by financially. Inflation, a high cost of living, and a dearth of affordable housing are leading to much economic unease.

While those earning less are undoubtedly more acutely affected (and the most worrisome trend), our study finds that even high income earners can’t keep up with costs. The large proportion of low income earners feeling this degree of economic concern indicates an alarming political volatility; the unusually high percentage of high income earners also feeling the pinch is potentially explosive. The fact that Canadians’ economic conditions are worsening is further cause for concern.

Methodology

The survey was conducted from August 1 to 8 using the Modalis Public Opinion panel – 100% recruited using random probability telephone sampling. Because the panel is built entirely using random probability sampling, it is valid to cite the margin of error for this survey. The survey is based on a representative sample of 1,618 Canadian adults and has a margin of error of +/- 2.4% points, 95 times out of 100. The survey data is weighted by age, gender, and region according to the latest Statistics Canada census.