In the latest release from our Canadian Public Omnibus, Canadians are most likely to point to investor or speculator activity as the key driver of home price escalation over the past decade.

Despite a steady drumbeat of experts pointing to housing supply, most Canadians believe investor/speculator activity is the key variable that drove up home prices.

Key findings in this release:

- Causes of housing price escalation over past decade

- Canadians favour elimination of investor/speculator activity in the single family home market

It’s the speculation, say Canadians.

The common refrain in housing experts is that increasing prices over the past decade has been driven by a lack of supply. The public thinks speculation is the biggest factor.

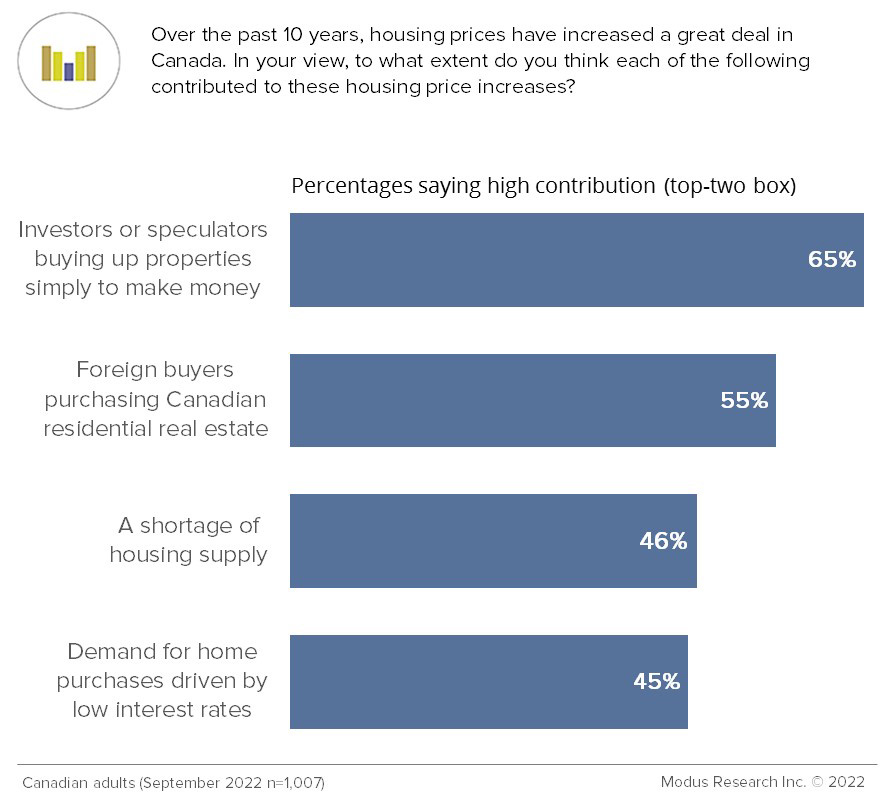

Two-thirds point to profit-driven investing/speculating as driving prices, while a majority also point to foreign buyers (also often speculative).

Relatively few see the escalation in housing prices as the result of a supply shortage or cheap credit.

Canadians want an end to large investors buying single family homes.

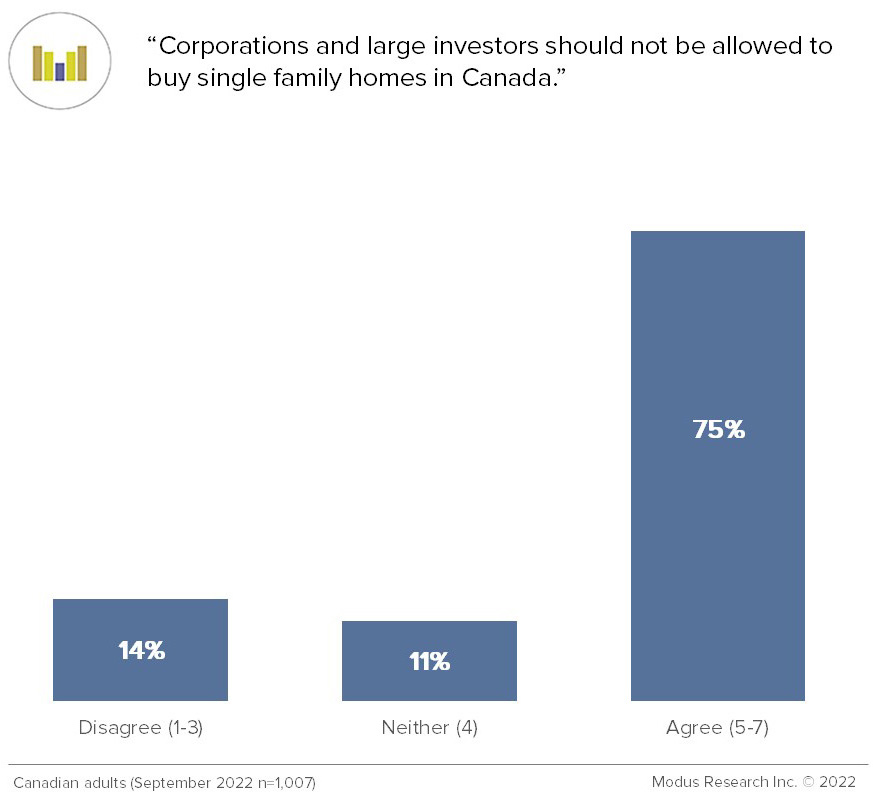

Fully three-quarters of Canadians agree that corporations and large investors should not be allowed to buy single family homes in Canada.

This view is held more or less uniformly regardless of age, gender, household income or region.

Canadians would support tighter regulation on home ownership.

Discussion

Our last release on housing in Canada revealed a desperate situation for many Canadian homeowners and renters. The cost of housing combined with inflation and rising interest rates are taking a toll. We asked if there are other options beyond rising interest rates to tame the housing market in Canada.

Despite a steady chorus of experts saying a shortage of supply is driving housing costs upward, most Canadians believe investor or speculator activity is the big issue. They also believe (in even larger numbers) that large investors should not be allowed in the single family home market in Canada.

Methodology

The survey was conducted from September 1 to 20 using the Modalis Public Opinion panel – 100% recruited using random probability telephone sampling. Because the panel is built entirely using random probability sampling, it is valid to cite the margin of error for this survey. The survey is based on a representative sample of 1,007 Canadian adults and has a margin of error of +/- 3.1% pts 95 times out of 100. The survey data is weighted by age, gender, and region according to the latest Statistics Canada census.