Pessimism about vaccine efficacy has grown substantially and affects the likelihood of workplace vaccine mandates.

The results from the annual year-end survey for The Business Monitor reveal a growing schism around vaccine mandates. The Business Monitor is a regular B2B omnibus service and is powered by the Modus Business Panel, Canada’s only scientific, purpose-build business research panel.

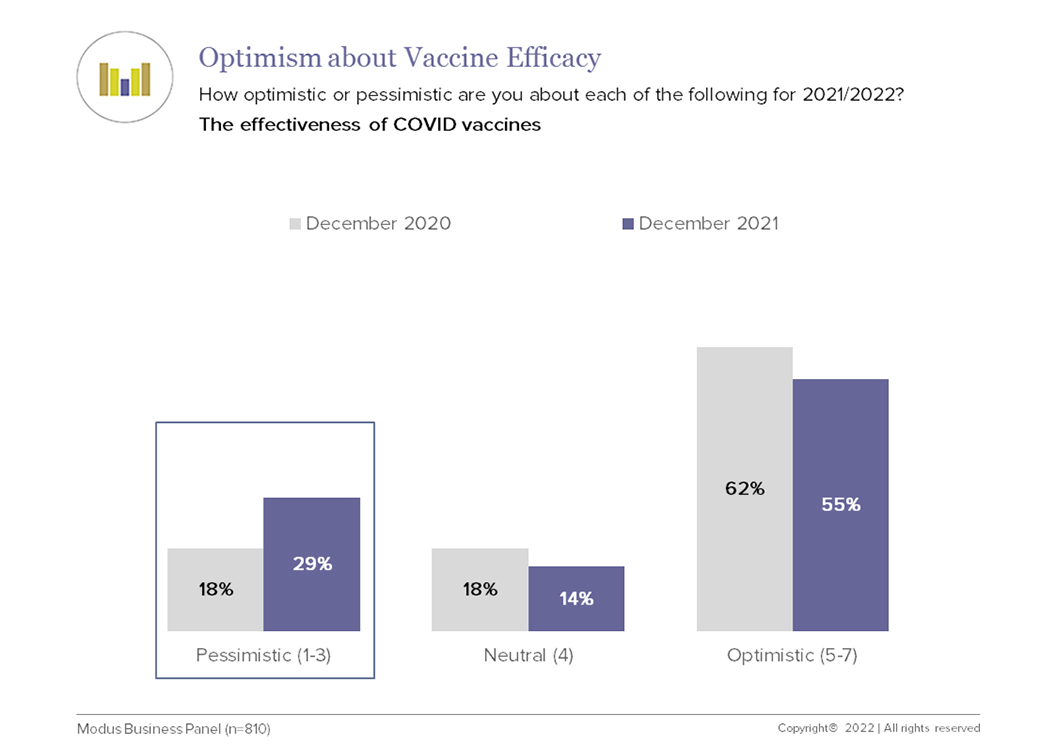

Doubts about COVID vaccines have grown

Over the past year, pessimism about the efficacy of vaccines has nearly doubled, growing by over 10 percentage points. At the end of 2020, The Business Monitor measured business leaders’ optimism about the effectiveness of COVID vaccines just as they were about to roll out in Canada. There was a good level of optimism and only a small minority were pessimistic. A year later, we are seeing a notable shift with over a quarter of business now doubting the efficacy of COVID vaccine.

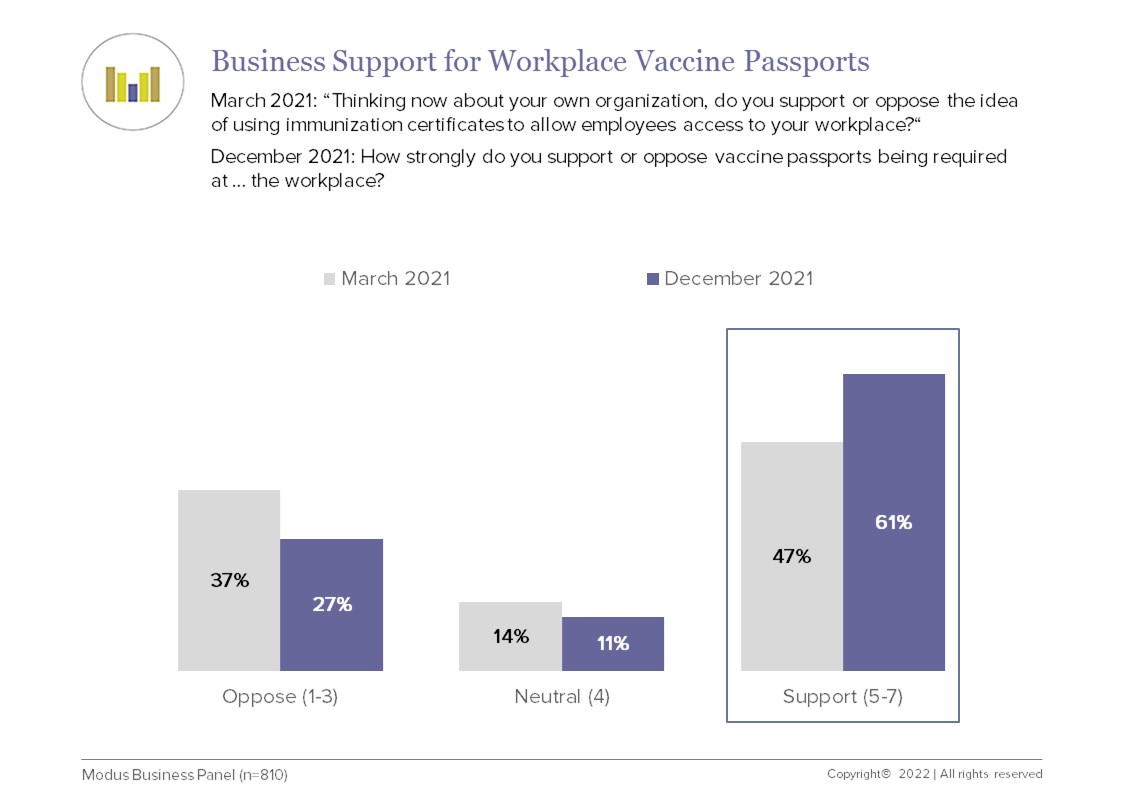

Despite growing doubts about COVID vaccines, employers are now more supportive of workplace mandates than in the spring

Support for workplace vaccine mandates has grown 14 percentage points since the spring. A solid majority of Canada's business leaders now support workplace vaccine mandates.

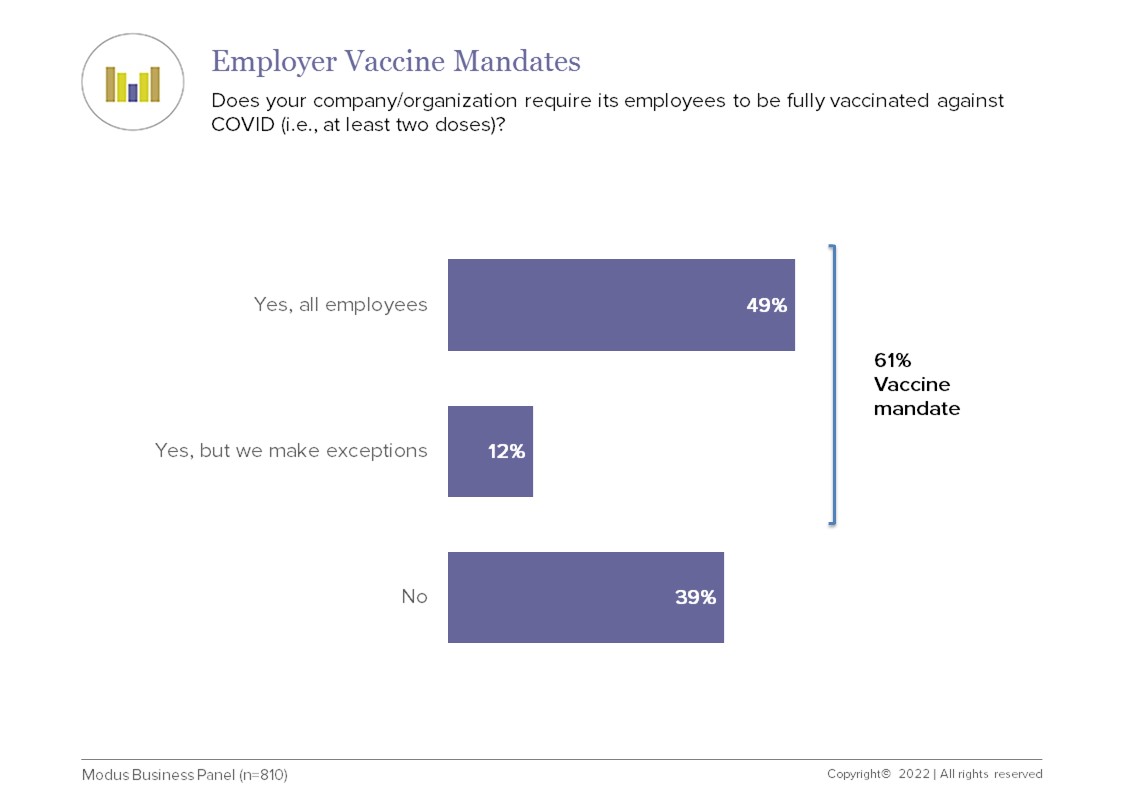

Canadian companies show a notable divide on vaccine mandates

One year into the vaccine rollout in Canada, a majority of employers have a mandate requiring employees to be vaccinated against COVID. This reflects the level of support for workplace vaccine mandates.

However, there is a very substantial number of employers with no mandate, showing clear polarization on the issue. These results do not vary meaningfully by company size, sector or location.

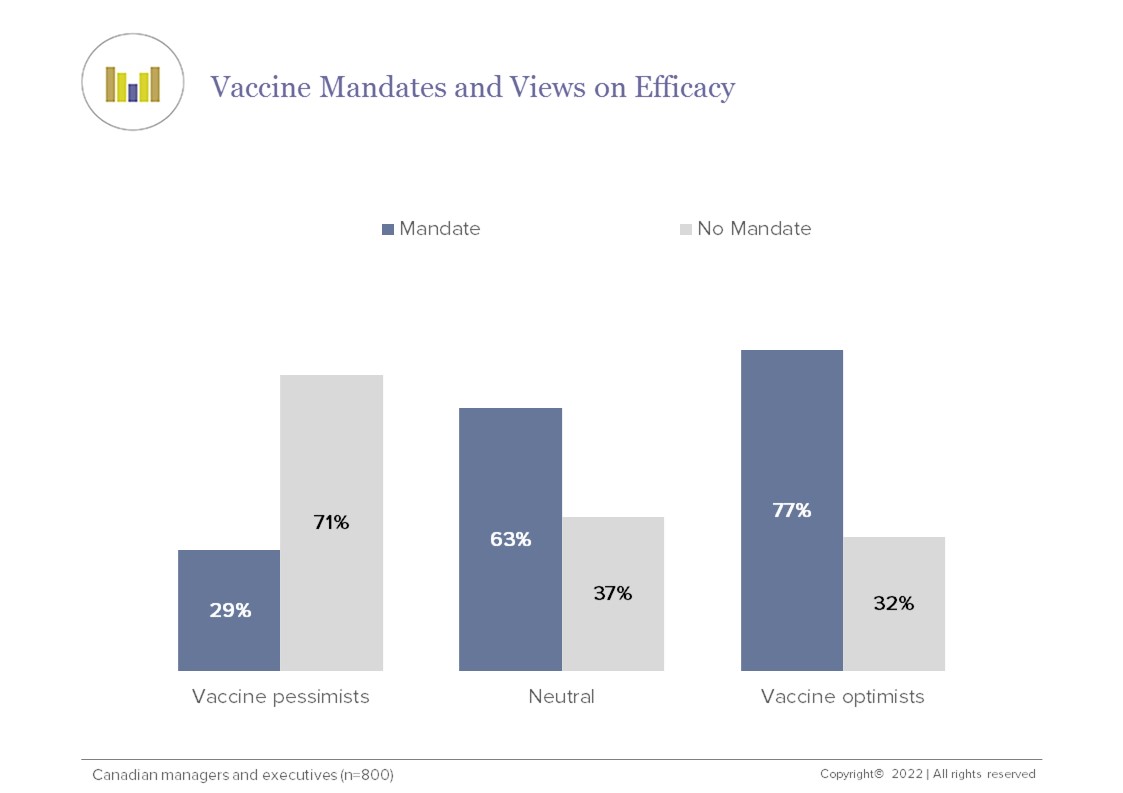

Doubts about vaccine efficacy results in a much lower incidence of vaccine mandates

There is a strong correlation between vaccine pessimism and whether or not employers have a vaccine mandate. The vast majority of companies with executive doubting the efficacy of vaccines have no employee mandate. The reverse is true not only for vaccine optimists but also those who are neutral about the efficacy of COVID vaccines.

In fact, deeper analysis of these data reveal that vaccine skepticism drives decisions to have no vaccine mandate.