In the latest release from our Canadian Public Omnibus, we find that it is not only renters who are struggling to deal with the cost of housing in Canada but also homeowners.

Large numbers of both groups are cutting expenditures in essential areas like food, raising questions about what housing affordability means.

Key findings in this release:

- Cost of housing is out of control

- Homeowners and renters cutting back on a range of essential expenditures

- Most Canadians see no end in sight for increasing housing costs.

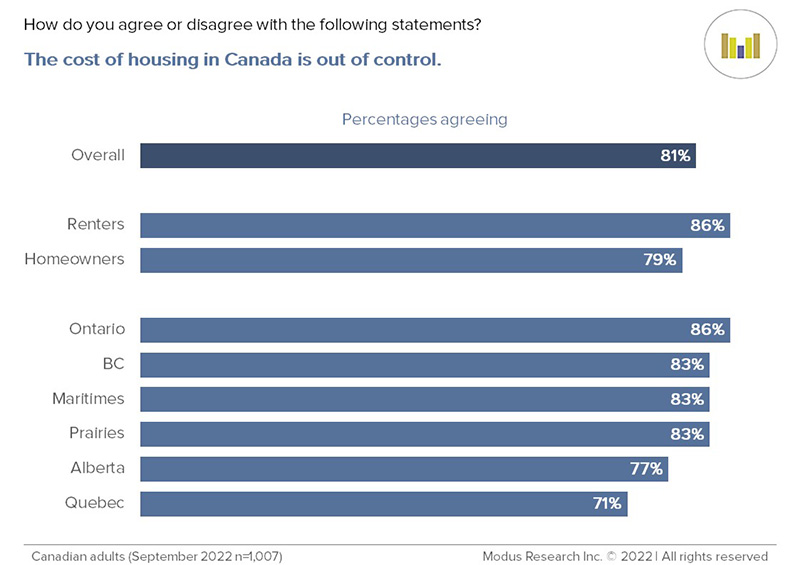

Nearly everyone agrees that housing costs in Canada are out of control.

Reflecting a dire situation for Canadians, slightly more than 8 in 10 think that the cost of housing is out of control.

- This finding holds for both renters and homeowners and is also consistent across all income groups from the lowest to the highest.

There are some regional variations but this view is held by a wide swath of the population regardless of location.

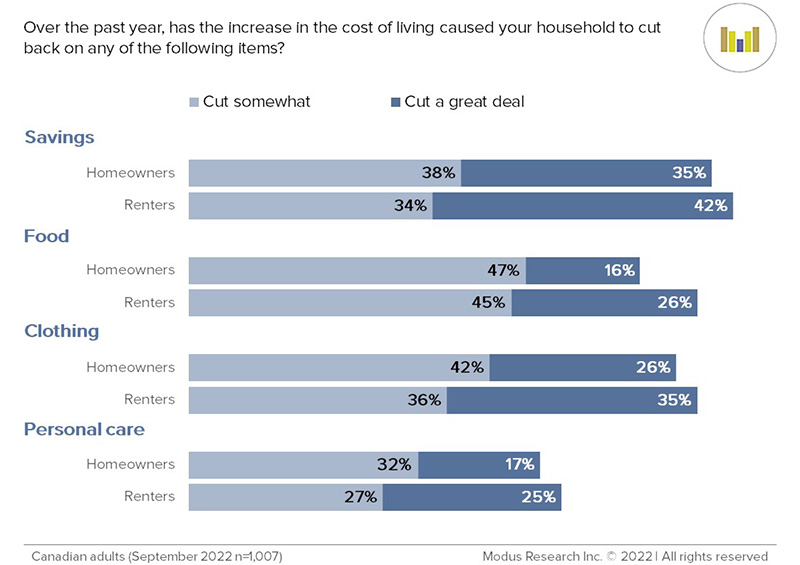

Alarmingly, large numbers of Canadians - renters and homeowners alike - have been cutting essential household expenditures.

It is often correctly reported that renters are feeling the brunt of the current housing affordability crisis. What is not so well recognized is the extent to which homeowners are feeling this pain as well. Many homeowners are heavily leveraged after 20 years of escalating home prices in Canada.

Sizable majorities of both homeowners and renters have been cutting food, clothing and personal care expenditures, as well as savings.

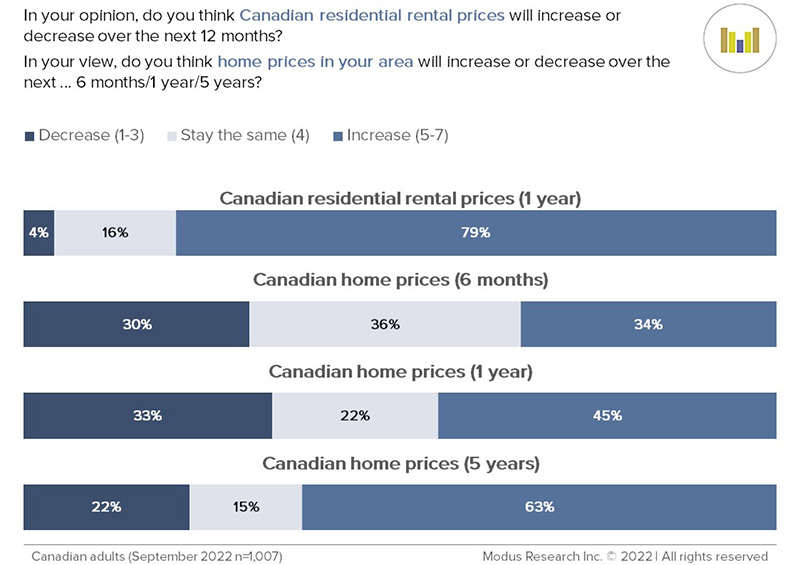

Even more concerning is that most Canadians see no end in sight for this housing cost crisis.

Most Canadians foresee worsening housing costs for both renters and homeowners.

As Canadians look out over the short-, medium-, and long-term, increasing numbers foresee escalating home prices. Most see the current correction in home prices as a short-term blip.

Almost everyone anticipates increased rents. Almost half (47%) think rents will increase a great deal over the next year (top-two box).

Discussion

These results paint a pressing situation for large numbers of Canadians. Household budgets are clearly under strain for homeowners and renters alike, raising new questions about housing affordability in Canada. In an environment of higher inflation and rising interest rates, a majority of both groups have been cutting food expenditures, among other essential items.

Despite escalating home prices over the past 20 years in Canada, housing affordability was seen as largely unaffected by prices due to historically low interest rates. Canadian households have taken on a great deal of debt over this time. Increasing interest rates will strain household budgets further.

Canadians are very troubled about the cost of housing itself. They expect rents and home prices to worsen for the foreseeable future. Rising interest rates may tame home prices but can other measures (that do not strain household budgets) be taken to reduce housing costs in Canada?

Our next release from this survey will show that Canadians view speculation (particularly by large players in the market) as the key driver of escalating home prices.

Methodology

The survey was conducted from September 1 to 20 using the Modalis Public Opinion panel – 100% recruited using random probability telephone sampling. Because the panel is built entirely using random probability sampling, it is valid to cite the margin of error for this survey. The survey is based on a representative sample of 1,007 Canadian adults and has a margin of error of +/- 3.1% pts 95 times out of 100. The survey data is weighted by age, gender, and region according to the latest Statistics Canada census.